TL;DR (Top 5 Takeaways)

- Visa and Mastercard introduced a new proposed settlement that would lower certain swipe fees and give merchants more flexibility, pending court approval.

- The proposal includes a 0.10% reduction for five years and a 1.25% cap on some standard consumer card interchange categories for eight years.

- Most merchants will see modest savings unless their card mix includes a high number of the consumer card categories that qualify for the cap.

- Merchants can still lower costs right now through compliant surcharging, Visa’s Commercial Enhanced Data Program (CEDP), interchange optimization, Level Two and Level Three data, and transparent pricing models.

- Card payments dominate spending in the United States. Credit cards alone account for roughly 32% of all payments by count. Because of this, even small fee reductions can have a real financial impact.

The Rise of Card Payments: Why Swipe Fees Matter More Than Ever

Credit and debit cards are the primary way consumers pay today, which makes swipe fees one of the largest operational costs for many merchants.

Recent Federal Reserve payment data shows:

- Credit cards account for about 32% percent of all consumer payments by number, and debit cards account for about 30%.

- Roughly 72% percent of consumers used a credit card at least once within the past 30 days, and 83% percent used cash at least once. However, cards still represent a larger portion of spending by total dollar value.

- Card networks collect tens of billions of dollars in interchange fees each year.

- Because cards are used so often, even small changes to swipe fee rules can affect merchant profitability in meaningful ways. That is why the recent announcement matters.

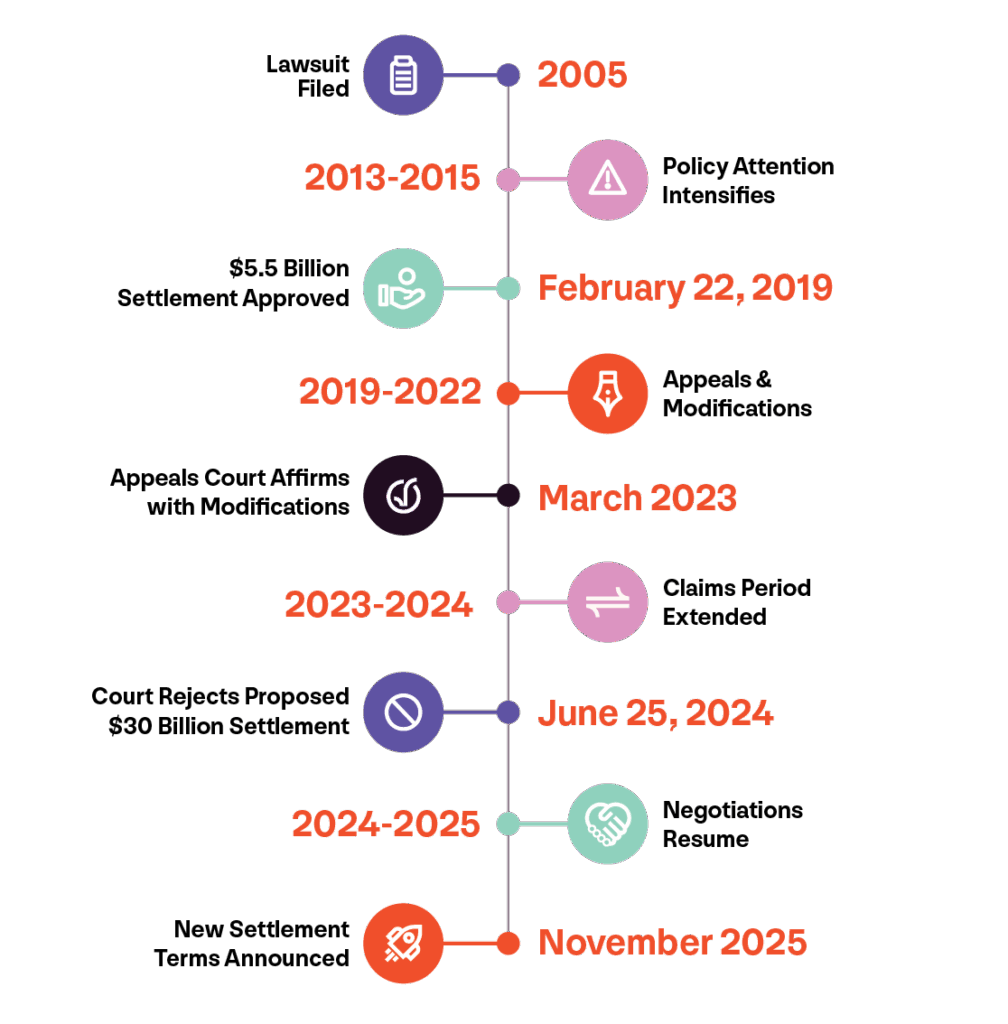

The 20 Year Fight Over Swipe Fees: A Detailed Timeline

2005: Lawsuit Filed

Merchants file a major antitrust class action against Visa and Mastercard, claiming the networks and issuing banks worked together to fix swipe fees and limit merchant steering options.

2008-2012: Discovery & Consolidation

The case undergoes years of motions, discovery, and consolidation as more merchant groups join the litigation.

2013-2015: Policy Attention Intensifies

Lawmakers increase scrutiny around steering rules, competition concerns, and market concentration. Several states explore new legislation.

February 22, 2019: $5.5 Billion Settlement Approved

The United States District Court approves a $5.5 billion monetary settlement that compensates merchants who accepted cards between January 2004 and January 2019.

2019-2022: Appeals & Modifications

Appeals and additional rulings shape how and when settlement funds can be distributed.

March 2023: Appeals Court Affirms with Modifications

The Second Circuit allows the claims process to move forward after revising aspects of the order.

2023-2024: Claims Period Extended

Merchants receive claim notices, and deadlines are extended into 2024 and 2025.

June 25, 2024: Court Rejects Proposed $30 Billion Settlement

Judge Margo Brodie rejects a newer, broader settlement proposal, stating that the relief was insufficient.

2024-2025: Negotiations Resume

Networks and merchant coalitions return to negotiations.

November 2025: New Settlement Terms Announced

Visa and Mastercard announce a revised proposal that includes the following terms:

- A 0.10% reduction in swipe fees for five years

- A 1.25% cap on standard consumer interchange for eight years

- Broader ability for merchants to decline certain premium card categories

- Additional flexibility for surcharging, subject to state law and network rules

This proposal still must be approved by the court.

What Happened: A Clear Breakdown of the New Settlement

This is the most significant update to interchange rules in years, although the benefits vary depending on the type of business and card mix.

Key terms include:

- 0.10% interchange reduction for five years: This is small but still meaningful. Many merchants will save a few hundred dollars per year.

- 1.25% interchange cap for specific standard consumer credit cards: This is the most impactful part, but it applies only to certain card categories.

Under the proposed settlement, Visa and Mastercard classify credit cards into three broad categories: standard consumer, premium consumer, and commercial cards. Merchants would have the option to accept or decline cards by these categories. The 1.25% cap applies only to the standard consumer credit card category, not to premium/rewards cards or commercial cards.

Standard consumer cards generally include non-reward or basic credit cards, such as many lower-fee or non-cash-back cards.

Premium consumer cards include high-reward and high-tier products like Visa Signature, Visa Infinite, Mastercard World, World Elite, and World Legend.

Commercial cards are corporate, business, fleet, and purchasing cards issued to companies or organizations rather than individual consumers. These cards typically carry higher interchange rates because they support added capabilities such as expense reporting, enhanced data requirements, and spending controls.

- More freedom to accept or reject certain card types: Merchants may be able to decline premium rewards cards and certain commercial cards. For example, premium cards like Visa Infinite or Mastercard World Elite could be declined under the new rules.

- Expanded surcharging options: All surcharge programs must follow state laws and card network rules.

- Court approval is still required: Nothing changes until the judge signs off. We will share updates as soon as the court schedules a final approval hearing or provides clearer signals about when the settlement changes may begin taking effect.

Reactions across the industry vary. Card networks highlight increased flexibility, while merchant groups argue the relief does not go far enough.

How Merchants Can Keep Processing Fees Low

Even with the new settlement, the most powerful cost-saving strategies rest in the merchant’s hands.

1. Implement a compliant surcharge program

- You can pass part or all of your credit card processing costs to customers.

- You must follow network rules and state laws, and you must provide clear notices.

2. Encourage lower cost payment types

For example:

- Offer a debit discount

- Provide a small cash incentive

- Highlight debit as the preferred option where allowed

3. Use interchange optimization for B2B transactions

Provide enhanced data such as Level 2 and Level 3 to reduce interchange fees on corporate and government cards.

4. Choose interchange plus pricing

Replace bundled pricing with transparent, cost-plus models.

5. Avoid interchange downgrades

- Downgrades happen when information is missing or batches are late.

- Solutions include batching daily, collecting AVS data, using consistent MCC and tax information, and following formatting requirements.

6. Work with a processor who provides detailed analytics

Understanding your card mix helps you make better financial decisions.

What This Means for ISVs, Agents, & Payment Providers

This settlement will influence merchant conversations throughout 2026.

Sales teams should:

- Update all scripts and decks with the settlement basics

- Run interchange audits for merchants to show projected savings

- Teach merchants the difference between “cap-eligible” and “reward/commercial” card categories

- Offer enhanced pricing programs such as surcharging or cash discounts

- Explain what is not changing: premium rewards cards will still cost more

- Prepare for many merchants asking: “Should I reject premium cards?”

Compliance, Customer Experience, & Risk Considerations

Flexibility is helpful, but execution must be thoughtful.

Merchants must:

- Follow state laws related to surcharging

- Follow Visa and Mastercard disclosure requirements

- Use proper signage at the entrance and at checkout

- Train staff on how to explain surcharges

- Monitor customer satisfaction and cart abandonment

- Test any new pricing approach through a pilot program first

Frequently Asked Questions

Q. Is the settlement final?

A. No. The court still needs to approve it. We will provide updates once the court sets a hearing date or offers new guidance that indicates the expected timeline for approval and implementation.

Q. Will swipe fees disappear?

A. No. This reduces certain fees, but interchange will remain a significant cost.

Q. Can merchants reject premium rewards cards?

A. Possibly, but only in limited situations. It still creates operational challenges. Specifically, the settlement lets merchants decline premium consumer cards (like Signature, Infinite, World Elite), but there’s risk: those are often high-spend or loyal customers and rejecting them may hurt sales or brand loyalty.

Q. Can I surcharge debit cards?

A. No. Only credit cards can be surcharged.

Q. Does this make cash discounts more appealing?

A. Yes. Alternative pricing strategies have become more compelling.

Q. How do I know if my transactions qualify for the one point two five percent cap?

A. Your processor needs to review your card mix.

Q. Will customers change behavior if I add a surcharge?

A. Some will. Most shift to debit, which is usually less expensive for merchants.

Q. When will I see savings?

A. Savings begin only after the court approves the settlement and implementation rules are finalized and take effect.

Conclusion: What Merchants Should Do Next

This settlement represents the most significant change to swipe fee rules in many years. That being said, the actual savings may vary. Most merchants will only notice a small difference unless they process a lot of standard consumer cards that fall under the new cap.

As the court process continues, we will keep you informed when a final approval hearing is scheduled and when there are clearer signs of when the new rules may take effect.

Merchants should use this moment to:

- Review their interchange costs

- Consider surcharging

- Encourage debit usage

- Work with a processor who offers transparent pricing and interchange optimization strategies

Final Thoughts

Credit card processing fees can feel complicated, but once you understand the structure, everything becomes much clearer. Interchange and assessments are standard across the industry. What a merchant truly controls is the quality of the transaction data, the technology used, and the pricing model chosen.

Merchants who focus on data accuracy, consistent card updates, fraud prevention, and strong processing tools often reduce their overall cost without changing a single thing about how their customers pay.

by Xplor Pay

-

First published: November 21 2025

Written by: Xplor Pay